6th April 2022

Due to the COVID-19 pandemic, the employment taxes end of year reporting is not as straightforward this year.

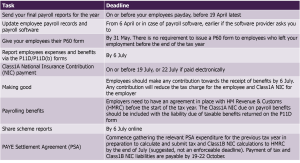

Below, we explain some typical tasks that are involved in the end of year reporting and how you can best prepare, whilst highlighting issues that should be considered for this and the following tax year.

Changes from 6 April 2022 that should be implemented into the payroll process

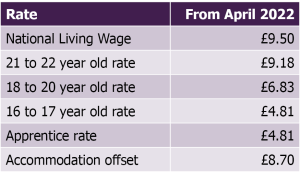

- National minimum/living wage increases from 1 April 2022

- Temporary increase in employer and employee NIC of 1.25% each due to the introduction of the Health and Social Care Levy

- Alignment of employee primary NIC threshold with basic tax allowance of £12,570 (£9,880) from July 2022

- Increase of employment allowance from £4,000 to £5,000 for those businesses whose employers’ Class 1 NIC liabilities were less than £100,000 in the previous tax year

Other considerations

- With employees returning to the office, some companies may be considering reinstating cancelled or postponed annual functions, such as Christmas parties, so it is possible that the £150 inclusive of VAT threshold may be breached where two annual functions are held in the same tax year

- Hybrid working and possibly the Green agenda has meant that businesses need to consider their expense policy in relation to travel expenses, as well as the reporting of taxable costs. Something that comes to mind is the provision of bicycles under their cycle-to-work schemes. One of the key criteria for the exemption is that the cycle is to be used ‘mainly for qualifying journeys’. This condition was relaxed for employees who joined and received their cycling equipment on or before 20 December 2020 and the easement ends on 5 April 2022

- Some benefits are exempt from tax or NIC liability such as work-related training, health screening, interest-free loans of up to £10,000, trivial benefits (up to £50 inclusive of VAT per event), annual events such as Christmas parties (£150 inclusive of VAT per attendee) and weekly contributions of £6 per week by your employer towards the cost of working from home. Exemptions should be utilised wherever possible to reduce the tax and NIC liabilities

Conclusion

In the last couple of years, the employment taxes field has seen a raft of employment taxes easements being introduced which are now falling away. Additionally, with hybrid working, certain benefits such as company cars are not as appealing, meaning that a more attractive option should be available such as electric cars or other benefits.

Staying compliant in this ever-changing environment is difficult, so please contact the Employment Tax team should you have any questions or require further assistance.